How to make money trading oil

Before investing in burning oil should have a minimum set of knowledge about what it is and how you can make money on this.

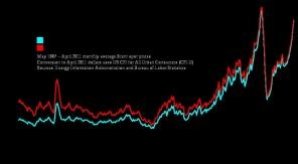

Brent oil (North Sea oil) price trend from May 1987 to April 2011.

Brent oil is a light crude oil were recovered from the North Sea.

There is some confusion among investors about why they call this crude for burned, let us first get it out of the way. Brent oil is named after a species of goose which in English is called Brent goose. This comes from the time the oil company Shell Oil oilfield named after various birds, and the North Sea was called the burning field. Another name of this oil is otherwise "burned dazzling", "London Brent, also called North Sea oil.

Brent oil is based on burning market. This is an informal venue where the annual sales of approximately 100 milliardrer dollars in oil contracts.

What is London brent oil?

Brent oil is characterized by its high quality and that it is a light crude oil. It is however not as easy as WTI. Brent oil inneholoder 0.37% sulfur and is therefore called for sweet crude.

Brent oil is used mainly for the production of gasoline and distillates. The oil is typically refined in Northwest Europe, with less favorable rates facilitate the export of oil (then refined the like in the U.S. Gulf and in areas around the Mediterranean).

How to trade Brent oil

From 2005 it became very easy to buy and sell burnt oil, since it was only when the trade went over to an electronic intercontinental trade format.

It is important to note the trading symbol for burning oil. What symbol is depends on which broker you use.

It's probably much easier to put into trade with burning oil by trial and error. You do not put much money on the table, it is at first anyway talk about a learning process, and so you can make money on good trades in the oil market when they have learned their lesson and gained some experience.

Easy Steps to shop burnt oil:

- First, you need access to a commercial service that offers commodity trading.

- Watch the news and make up your own mind about burning oil market. If you use a broker will have access to relevant news about commodity that is written specifically for short-term trading.

- Perform technical analysis (optional). Some online brokers (including some brokers offline) has good technical tool that allows you to analyze historical rates, and on the basis of these prices might try to form forecasts of future price developments. It is actually not very difficult to learn how to use technical tools at most brokers, they have useful explanations which makes it all a lot easier. Technical analysis is a widespread form of analysis in most financial markets, and offers good methods to help you make the right decisions that provide the best avkasstningen.

- Once you have formed you an opinion on the market can begin trading in burning oil. Assuming you've put money into your customer account, you can very easily start shopping. Not all online brokers are as easy to use but by some brokers are more intuitive so that any further explanation of the method here would have been unnecessary.

Be rich like a sheik on oil from the Middle East

Mid East Sour Crude Futures is an exciting investment opportunity. Find out what it takes to get rich trading in oil, and learn about trading systems that make it possible.

Middle East is usually associated with three words: war, money and oil. The oil has caused some nations and individuals in the Middle East have become rich in economic prosperity, but it is known that not happened without conflicts.

that trader now has the opportunity to grab your piece of the pie from the immense profits from the Middle East. The key word is investment in Mid East Sour Crude Futures.

East sour crude oil is derived from Middle Eastern countries, ad especially Saudi Arabia, Kuwait, Iran and Iraq. The region has more than 60% of the world's known oil reserves. The distinct composition of this type of crude oil is that it is composed of sulfur and other impurities. Hence it difficult to refine, and a special challenge is refining the unleaded gasoline.

Trade futures from Middle East oil

Acquisition of East Sour Crude Futures are standardized contracts where the buyer agrees to receive a specific amount of sour crude at a predetermined price and which is valid for a specific date.

an East sour crude futures trader who can hedge your position against movements in oil prices. Companies and individual traders can benefit from this type of hedging as a risk adjustment in the portfolio, or as pure speculation.

Crude oil futures are extremely popular among financial instutisjoner well as with traders. Some brokers has private traders a range of opportunities for trading in oil derivatives. Trading platform is possibly the best of its kind online and is really recommended to those considering seriously to begin with this.

Trading of futures in East sour crude oil from the Middle East going through the Intercontinental Exchange (ICE). ICE added this derivative led away in May 2007. Some characteristics are its low liquidity, contracts with high spread, and they must be regarded as a relatively high-risk investment.

Crude oil trades electronically, and the underlying raw material for the futures contract that we have discussed here is crude oil from Dubai, Oman and upper ZAKUM (from Abu Dhabi). Futures traders in lots of 1,000 bbl, and the minimum price movement is 1% per barrel. There is no upper maximum.

Will you be rich in oil trading, one must of course have the knowledge and be willing to risk their own money.

Trading in oil and gas

Gas extracted from the crude oil used for heating and for generating energy. By investing in gas oil can achieve an excellent return. A good strategy and knowledge is of course necessary to succeed.

gas (or gas oil) is a product of crude petroleum and used to heat and to generate electricity. There is a middle distillate and also called for heating oil. The English term is "gas oil".

Gas oil accounts for about 25% of the yield from a barrel of crude oil. So that is the second largest income range per barrel of oil for gasoline. Now that there are fewer gasoline-powered vehicles and more hybrid cars and gas powered vehicles coming onto the market will probably increase this share further.

You can make money by speculating in the gas / gas prices, almost the same way as you speculate in stocks. Gasoil traded otherwise widely in Europe as a hedging tool for the physical industry.

trader who can perform trading in gas oil via futures and options and various options contracts. The availability of several commercial contracts provides traders good flexibility, making it possible to manage price risk.

Trading of futures contracts in gas oil carried through the Intercontinental Exchange (ICE) and the New York Mercantile Exchange (NYMEX).

In addition to traders, there are other major players who speculate in gas oil. The financial product often purchase futures (futures, CFDs, etc.), and purchased by, among other major transport companies to hedge against changes in the cost of diesel and jet fuel.

The underlying physical assets for gasoil futures contracts offered on the ICE exchange, which called for "gas oil barges", delivered in ARA (Antwerp, Rotterdam and Amsterdam). Gasoil futures contracts are used as a benchmark for the pricing of all distillates in trade in Europe and other countries.

How to trade WTI crude oil

West Texas Intermediate (WTI) crude oil is a light, sweet crude oil produced in Midland in West Texas, USA. Which trade contracts based on depends on the platform used.

WTI is a type of crude oil used as a benchmark in oil prices and the underlying commodity for futures contracts on the New York Mercantile Exchange Index (NYMEX).

Featured on WTI crude oil is its high quality and a sulfur content of less than 5 percent, making it easy to refine. It has a slightly sweet taste, which is why it is described as light sweet crude.

WTI crude oil has a lower level of other impurities as well, and as a result, it is much easier and cheaper to refine than for instance oil from the Middle East. Moreover, it is easier to transport WTI oil than heavy sour crude, since the latter has a high wax content, higher density and high viscosity.

Due to its scarce availability is likely demand for WTI crude always remain high.

All the above factors are helping to make WTI crude oil to the world's most liquid oil in the online marketplace.